MM Curator summary

The article below has been highlighted and summarized by our research team. It is provided here for member convenience as part of our Curator service.

[MM Curator Summary]: Wonders never cease.

Clipped from: https://www.northcarolinahealthnews.org/2023/07/12/state-officials-delay-the-rollout-of-specialty-medicaid-plans-again/

The repeatedly delayed rollout of specialized health care plans for tens of thousands of Medicaid beneficiaries — those with complex, often behavioral health needs — has been postponed indefinitely, the N.C. Department of Health and Human Services announced Tuesday.

This marks the third time the state has pushed back the launch of so-called tailored plans for individuals who require more extensive care and support than average Medicaid enrollees. Some of the groups expected to eventually transition to tailored plans include people with intellectual or developmental disabilities, people with substance use disorders and traumatic brain injuries, low-income seniors living in nursing homes and many people with severe mental health issues.

DHHS originally said these groups would be moved to tailored plans in December 2022 before delaying the launch to this April and then again to October. In a news release announcing the latest postponement, the agency said it is “not able to announce a certain go-forward date at this time.”

“The Department has been working collaboratively with the legislature to achieve the necessary tools to administer the Tailored Plans on par with other managed care plans, but they are still a work in progress,” the release said. “Further, uncertainty with the state budget, which will fund transformation costs and rebase for the Medicaid program, creates additional needs for launching Tailored Plans.”

Another issue, the agency suggested, is a lack of readiness among the six behavioral health organizations that will coordinate care for tailored plan enrollees across the state. Those state-supported managed care agencies, known as LME-MCOs, are Alliance Health, Eastpointe, Partners Health Management, Sandhills Center, Trillium Health Resources and Vaya Health. The departmental statement said “progress has been made” in ensuring that those organizations have the “technical capabilities” needed to implement the tailored plans.

The LME-MCOs are meant to act as intermediaries, connecting eligible enrollees with health care providers who will be reimbursed through tailored-plan contracts. But some providers have been reluctant to accept this arrangement, making it difficult for the organizations, all of which serve multiple counties, to ensure that eligible beneficiaries have access to care where they live.

‘Continued gaps’

In its announcement on Tuesday, DHHS acknowledged that “gaps remain in provider networks” — echoing comments made by Jay Ludlum, deputy secretary for N.C. Medicaid, during a June 14 symposium in Raleigh organized by the i2i Center for Integrative Health.

“There are continued gaps in contracting,” he said at the time. “We are seeing that it’s primarily around one system that is not contracting, and I’m not going to mention them by name. We are trying to encourage them to engage in that contracting. I think that that’s really important.”

Jay Ludlam, deputy secretary of Medicaid for N.C. DHHS, speaks at the Hilton Raleigh North Hills hotel on June 14, 2023. Credit: Jaymie Baxley/NC Health News

While Ludlum did not identify the holdout, Rhett Melton, CEO of Partners Health Management, in March said his organization was having difficulty contracting with Atrium Health. The Charlotte-based provider, which is the country’s eighth-largest hospital system, has about 2,700 acute care beds in North Carolina, nearly 150 of which are for patients with mental health needs.

“Atrium has the health care market, if you will, for us in [our region],” Melton said during a meeting of the Joint House and Senate Appropriations Committee on Health and Human Services. “When we don’t have the contract with Atrium, that displaces about 25 percent of our members.”

Atrium, in turn, appeared to take a swipe at the behavioral health organizations in a statement to NC Health News, referencing the ongoing capability challenges described by DHHS.

“Our intent is to be contracted with each of the payors in this space to support this vulnerable patient population and its growing needs,” a spokesperson for the system said in an email Tuesday. “As the state has noted publicly, there are gaps in the technological capabilities and operational readiness of the tailored plans. We look forward to being able to move forward when the department and the plans have resolved these issues.”

‘Key issues outstanding’

Tailored plans have been a work in progress ever since North Carolina switched to a managed-care Medicaid system in 2021. While managed care is not unique to the state, North Carolina’s system differs from the traditional model by including plans tailored to the needs of some of the state’s most expensive patients, many of whom have complicated — often multiple — diagnoses, and who need a lot of support.

DHHS has said about 150,000 people, or 5 percent of the state’s Medicaid participants, are expected to move to tailored plans when the plans eventually go live, but it is not yet clear if that can happen without Atrium’s participation. It also remains to be seen when the behavioral health organizations will be fully prepared for the plans’ rollout.

Anthony Ward, CEO of Sandhills Center, said his organization “values the integrated, whole-person approach included in the Tailored Plan design.”

“We are committed to continuing our work with the North Carolina Department of Health and Human Services on our preparation for the Tailored Plan launch when announced,” he said in an email to NC Health News. “We share NC DHHS’ focus on minimizing disruption for the members served by the Tailored Plans and have been working actively with community providers currently serving our members, including Primary Care Physicians, to contract with us in advance of the Tailored Plan launch.”

State health and human services Secretary Kody Kinsley echoed Ward’s comments in texts to NC Health News.

“Our team has worked very hard on this, and we believe in the whole-person vision that is core to the design of the tailored plans,” he said. “However, as I said before the joint oversight committee in March, we have key issues outstanding we need resolved.”

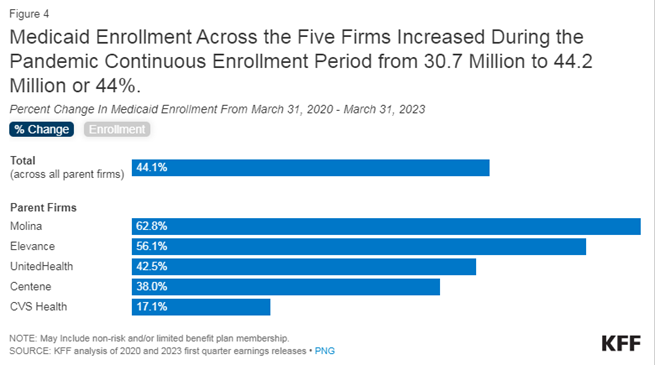

Legislation passed in March made North Carolina the 40th state to expand access to Medicaid. The expansion, which will not officially take effect until a state budget is approved, will provide coverage to about 600,000 people who currently lack health insurance. At the same time, an estimated 300,000 existing beneficiaries are expected to lose coverage through the unwinding of a federal mandate that prevented states from kicking people off the rolls during the COVID-19 pandemic. DHHS has confirmed that many of these individuals will become eligible for Medicaid again under expansion, once that takes effect.

Republish our articles for free, online or in print, under a Creative Commons license.