MM Curator summary

The article below has been highlighted and summarized by our research team. It is provided here for member convenience as part of our Curator service.

[MM Curator Summary]: All the reasons Medicaid members are frequent flyers at more than 2x even those with no insurance. And some thoughts on what to do about it.

Clipped from: https://www.cato.org/blog/medicaid-emergency-room-use

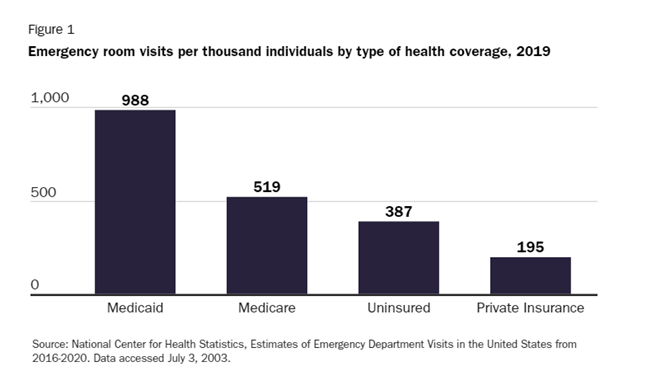

CDC data show that Medicaid beneficiaries visit emergency rooms more frequently than individuals with private coverage, Medicare beneficiaries, and even the uninsured. Because ER visits are so expensive, federal and state governments could realize large savings by reducing the gap in ER utilization between Medicaid beneficiaries and other individuals.

The accompanying figure shows ER utilization rates by coverage type in 2019, which are probably more indicative of post‐ pandemic usage than data from more recent years. Utilization rates across all four categories fell in 2020—the last year for which the CDC has published data—as fear of COVID-19 exposure kept prospective patients away from hospitals.

The gap between Medicaid and uninsured ER use seems counterintuitive. Uninsured individuals should have difficulty accessing many non‐ emergency medical services, but emergency rooms cannot turn anyone away (if the hospital participates in Medicare, as almost all do). On the other hand, hospitals can charge uninsured patients for services they receive in the ER, and the fear of a large bill is likely to deter many from visiting.

While Medicare and privately insured patients are insulated from such large hospital bills, they usually face a significant copayment. Government survey data show that ER co‐ pays of $100 to $250 are most common for privately insured patients, but some pay up to $1000.

By contrast, most Medicaid beneficiaries face little or no out‐ of‐ pocket costs for ER services. CMS gives states the option to charge Medicaid patients up to $8 if they visit an ER without having a true medical emergency. But, as of 2020, only fourteen states enforced this copayment provision, and some categories of beneficiaries (e.g., children and pregnant women) are exempt.

While Medicaid beneficiaries have little or no financial disincentive to visit the emergency room, they may not be able to access less costly alternatives. Survey data published before the pandemic showed that general practitioners were much less likely to accept new Medicaid patients than privately insured or Medicaid patients.

Although this acceptance gap is normally attributed to relatively low Medicaid reimbursement rates, many physicians cite bureaucratic hurdles to obtaining reimbursement as an additional deterrent. In any case, many Medicaid beneficiaries do not have a primary care doctor to call as an alternative to visiting the ER.

Another ER alternative is urgent care, which is a less costly alternative to the emergency room for a subset of acute medical issues. Urgent care facilities accept Medicaid patients in some but not all states. For example, Kaiser Permanente takes Medicaid patients at its urgent care centers in two of the states in which it operates, but does not accept them in six other states plus the District of Columbia.

One state that attempted to address the ER incentive problem is Kentucky. In 2018, the state obtained a waiver from CMS allowing it to implement a rewards program for certain Medicaid beneficiaries. Under this program, each qualifying Medicaid beneficiary receives an account that can be used for health‐ related benefits normally excluded from the state’s program including certain dental and vision services, other‐ the‐ counter medications, and gym memberships. The state deposits funds into a beneficiary’s account whenever the individual completes a recommended healthy activity such as getting a checkup, receiving a flu shot, or participating in a tobacco cessation program.

Originally, Kentucky planned to deduct funds from a beneficiary’s rewards account if he or she visited the ER without suffering a medical emergency. The deduction would range from $20 for the first unnecessary visit to $75 for the third such visit. However, this measure was dropped after Governor Matt Bevin failed to win re‐ election.

Since the deduction scheme was not fully implemented, its effects cannot be assessed.

Aside from asking Medicaid beneficiaries to share the cost of ER visits, providing options to the ER could also reduce utilization. If physicians are unwilling to accept more Medicaid patients, nurse practitioners and physician’s assistants to care for this population. But many states limit the scope of practice for these professionals, prohibiting them from working independently or prescribing drugs on their own. States should expand their scope of practice so that they can provide care to all patients.

Finally, it is worth noting that lack of a financial incentive to avoid the ER and lack of access to alternatives are not the only factors driving high ER utilization by Medicaid beneficiaries. Another factor driving ER use among the Medicaid population is its higher level of substance abuse. In 2020, Medicaid recipients accounted for 18% of the overall adult non‐ elderly population, but 21% of adult non‐ elderly individuals who have substance abuse disorders. Substance abuse can lead to more ER visits due to the threat of overdoses and of an increased risk of accidents while impaired.

There is unlikely to be a magic policy bullet that will reduce ER utilization by Medicaid beneficiaries to that of the privately insured. But states should experiment with financial incentives as a way to start addressing the problem.