This post is only available to members. You register for FREE here or login if you are already a member

Loading…

Loading…

6-minute read

Many of our clients are Medicaid health plan operational teams that manage vendor relationships. The article below is based on our experience working with Medicaid health plans who have been able to optimize their vendor management processes.

Most Medicaid health plans describe their vendor management scenario as “deluged” with vendor meeting requests. When our plan clients quantify the time they spend on each vendor sales effort, they realize that all the meetings and followup meetings and related correspondence and efforts add up to many hundreds (and sometimes thousands) of health plan staff hours. While some Medicaid plans have begun to implement more policies to manage this process, most plans still have room to optimize the return on this significant time investment.

Few vendors (especially new vendors) understand the way your plan prefers to manage procurement efforts. Each plan is different in how it prefers to engage with vendors. Some plans only meet with vendors related to a problem they are actively trying to pursue. Some only meet with vendors they have invited to respond to an RFP. Other plans meet with vendors at any time, to learn more about solutions or to get new ideas.

Once a vendor is engaged in a potential solution discussion, they will need to know what to expect in terms of different business units involved in the decision, information and data that will be needed to support the business case, what to expect in terms of acceptable pricing models and how long the overall process normally takes. Most vendors have no idea what to expect, and most plans do not communicate what to expect. Setting expectations from the start will go a long way to keep everyone aligned and making the best use of your precious time.

Sometime you need a solution to close HEDIS gaps for 100 members. Sometimes you need an overhaul of an entire process, or a brand new critical technology system. Rest assured, whatever the size of your problem, any solution vendor engaging you in a sales process wants to maximize the size and duration of the contract. If you do not set quantified scope parameters correctly, you will end up with a solution that either doesn’t go far enough or goes too far. Best practices include using a member-level target list (for interventions / gap closure based projects), starting with an initial pilot, and breaking any effort more than 60 days up into phases.

Vendors pitching you their solution will only show you their very best results. While this information is important, this should not be the only data you use to kick the tires of their capabilities. Ask for more than three references – this way you have a better chance of getting a broad perspective of what other plans have experienced with the vendor.

In addition to your own research into potential vendor partnerd, there are a few key tactics that can help you overcome some of the common challenges in the space.

6-minute read

Many of our clients are investment professionals working in the health and human services space (including the full spectrum from angel to VC to equity firms). The article below is based on our experience working with investors who have succeeded in this space.

One of the worst mistakes investors new to the space can make is to assume that strategies rooted in the commercial payer or Medicare Advantage space can be simply pivoted into the Medicaid space. The mistake is understandable, because few portfolio companies understand this risk and they do not know to communicate it to their investment partners.

Understanding that commercial and Medicare strategies need to be dramatically altered to work in Medicaid is the first step. The next risk is underestimating the learning curve for Medicaid. Each state operates its own Medicaid program, and most benefit, operational and procurement decisions are done independent from federal operations. We have a saying in our space: “If you have seen one Medicaid program, you’ve seen one Medicaid program.” Besides the policy differences across states, each state has its own agency and stakeholder environment, and navigating these is extremely complex for HHS veterans. Finally, the regulatory environment for this space evolves constantly, and in ways that greatly impact revenue projections. For those new to the space, critical mistakes and loss of time are guaranteed.

Many investors rely on the relational nature of other verticals for confidence in sales revenues. While relationships play an important role in the HHS space, most contracting is done using a defined competitive procurement process. This applies to both state agency and health plan contracts (though less so in health plans). Because of the regulatory and bureaucratic components, the sales cycle for this space is much longer and much more unpredictable than in other verticals.

The Medicaid space has two key components that drive unique pricing models: A focus on the rate-cell capitation payments to managed care plans, and long-standing efforts to implement value-based payment models.

Medicaid health plans are paid a per member per month (pmpm) fee by states to manage different populations (such as diabatics or pregnant mothers). All the costs for care and management of each member must be funded by those rates or the plan loses money. Each plan thus thinks of all vendor solution costs in terms of pmpm. This type of pricing is not the norm for most portfolio companies operating in the commercial space, and it may take a large effort to structure pricing models in a way that will succeed in the Medicaid space. Most portfolio companies price solutions at an aggregate level and do not have a way to assign costs at the plan member level.

The second challenging part of HHS pricing models is the focus on value-based payments. Most Medicaid state agencies and health plans are required to place an ever-increasing amount of their payments to providers in what is called a “value-based” arrangement. While precise definitions of these models remain elusive, the critical risk is not being able to clearly tie a portfolio company solution to specific member outcomes. Vendors should also be prepared with standard risk sharing arrangements to offer to prospects in the Medicaid space.

In addition to your own research into this vertical, there are a few key tactics that can help you overcome some of the common challenges in the space.

This is part of our Medicaid Concepts series, in which we provide a high level overview of key concepts in the Medicaid industry today.

Electronic visit verification (EVV) is a category of technologies and services used to validate that a visit actually occurred (usually in the member’s home). While EVV has been around for a long time, the 21st Century Cures Act made it mandatory for all state Medicaid programs by January 2020 for personal care services and January 2023 for home health services.

At a minimum, EVV systems must document:

MM Curator summary

Biden’s has officially selected his nominee for the top CMS job.

The article below has been highlighted and summarized by our research team. It is provided here for member convenience as part of our Curator service.

President Biden has selected Chiquita Brooks-LaSure to lead the Centers for Medicare and Medicaid Services, filling a major role in his health-care leadership team, according to four people who spoke on the condition of anonymity because they were not authorized to discuss the decision.

Brooks-LaSure served in the Obama administration as a senior CMS official who helped implement the Affordable Care Act’s coverage expansion and insurance-market reforms. She also worked on Capitol Hill as a Democratic staff member for the House Ways and Means Committee, building ties with then-Rep. Xavier Becerra, Biden’s choice to lead the Health and Human Services department and who sat on the committee at the time.

Clipped from: https://www.washingtonpost.com/health/2021/02/17/biden-medicare-chiquita-brooks-lasure/

MM Curator summary

The protest stage of the OK MCO procurement has begun, with Aetna batting first.

The article below has been highlighted and summarized by our research team. It is provided here for member convenience as part of our Curator service.

Aetna Better Health of Oklahoma is protesting the selection of four other private insurers to manage Oklahoma’s Medicaid program, according to The Frontier.

Four things to know:

1. In late January, Oklahoma selected four health insurers to manage its Medicaid program, called SoonerSelect. The winners were Blue Cross Blue Shield of Oklahoma, Humana Healthy Horizons, Oklahoma Complete Health (Centene subsidiary) and UnitedHealthcare.

2. Aetna Better Health of Oklahoma lost its bid to manage the program. In a 51-page protest filed Feb. 12, Aetna claimed the bid process was flawed, according to The Frontier.

3. Specifically, Aetna claimed the Oklahoma Health Care Authority unfairly evaluated the proposals, used a flawed scoring system to select winners, and didn’t properly review the insurer’s entire proposal.

4. The contract winners are set to begin managing Medicaid benefits for the state Oct. 1. The contracts are worth about $2.1 billion, according to StateImpact Oklahoma.

Clipped from: https://www.beckershospitalreview.com/payer-issues/aetna-protests-oklahoma-managed-medicaid-picks-4-things-to-know.html

MM Curator summary

Biden has asked SCOTUS to cancel a planned case on work requirements.

The article below has been highlighted and summarized by our research team. It is provided here for member convenience as part of our Curator service.

By James Romoser on Feb 22, 2021 at 9:12 pm

Elizabeth Prelogar, now the acting solicitor general under President Joe Biden, argues to the court during 2016. (Art Lien)

The Department of Justice asked the Supreme Court on Monday to cancel next month’s argument on the legality of Medicaid work requirements – a policy that former President Donald Trump promoted but is now being rolled back by the Biden administration. One of the states seeking to implement the policy, however, quickly opposed the federal government’s request, telling the justices that the dispute is not moot and should still be heard.

If the justices grant the request, it will be the third dispute this term to be nixed from the court’s docket as a result of a policy shift by the new administration. Earlier this month, the court called off arguments on two immigration issues – Trump’s method of funding his border wall and his “remain in Mexico” policy for people seeking asylum – after President Joe Biden abandoned the policies being challenged.

Biden’s top health officials similarly have begun unwinding a controversial health care initiative that encouraged states to require some Medicaid recipients to work as a condition for maintaining their health coverage. Among the states that received the Trump administration’s approval to impose work requirements were Arkansas and New Hampshire, but a district judge and the U.S. Court of Appeals for the District of Columbia Circuit declared those approvals illegal after finding that they would undermine the purpose of the Medicaid program, which provides insurance to 77 million Americans.

The Trump administration and the two states asked the Supreme Court to review the issue, and in December, the justices agreed to do so in a pair of consolidated cases, now known as Cochran v. Gresham and Arkansas v. Gresham. The Trump administration filed its brief defending Medicaid work requirements on Jan. 19, the day before Trump left office. The oral argument is scheduled for March 29.

That argument is no longer necessary, Biden’s acting solicitor general, Elizabeth Prelogar, told the justices in a seven-page motion on Monday. The Biden administration has “preliminarily determined” that work requirements do not serve Medicaid’s goals, Prelogar wrote. The Department of Health and Human Services has already rescinded a Trump-era letter setting forth legal justifications for the policy, and it has notified states that it may withdraw state-specific approvals. Moreover, Prelogar noted, the policy is, at least for now, practically defunct. That’s due in part to a COVID-19 relief bill in which states received extra Medicaid funding if they refrained from imposing any new eligibility restrictions in the safety-net program. Every state in the country took the deal.

In light of what she called the “greatly changed circumstances,” Prelogar asked the justices to cancel the argument and vacate the two D.C. Circuit rulings that are on review at the Supreme Court. The cases should be sent back to HHS so that agency officials can re-evaluate the Arkansas and New Hampshire proposals, Prelogar said.

The Medicaid recipients who are challenging the legality of the work requirements consented to the Justice Department’s request. New Hampshire “takes no position” on the request, Prelogar told the justices.

Arkansas, however, filed a brief on Monday evening opposing the request. The state noted that the Biden administration has not formally revoked the policy of permitting Medicaid work requirements – it has merely made a “preliminary” judgment that the policy is unsound.

“Preliminary proposals to rescind agency action do not moot challenges to or defenses of it,” Arkansas said in its brief.

The dispute, the state argued, thus remains a live controversy and continues to raise an important legal issue for the Supreme Court to resolve: namely, the scope of the federal government’s authority to allow states to enact experimental policies in Medicaid.

Clipped from: https://www.scotusblog.com/2021/02/federal-government-asks-court-to-scrap-challenge-to-medicaid-work-requirements/

MM Curator summary

States will now have to report more information on Medicaid supplemental payments to providers.

The article below has been highlighted and summarized by our research team. It is provided here for member convenience as part of our Curator service.

As part of the omnibus Federal appropriations bill enacted into law on December 27, 2020, Congress established new reporting requirements for states that make Medicaid supplemental payments. The new requirements follow on the heels of the withdrawal of a controversial proposed rule, which would have made more sweeping changes to Medicaid supplemental payments. As a result of the new law, the Centers for Medicare and Medicaid Services (CMS) will be developing a new reporting system for supplemental payments by October 1, 2021.

More than a year ago, in November of 2019, CMS issued the Medicaid Fiscal Accountability Rule (MFAR), a proposed federal regulation that included a number of significant changes to enhance federal oversight and scrutiny over Medicaid supplemental payments. As part of the MFAR, CMS would have required states to report extensive information about all Medicaid payments made to each provider receiving Medicaid supplemental payments, on both a quarterly and annual basis, as well as information about the source of any non-federal share used to finance such payments. MFAR also proposed to cap the size of Medicaid supplemental payments, require reauthorizations every three years, and limit the permissible local funds that could be used to finance the nonfederal share of the payments.

Former CMS Administrator Seema Verma announced on Twitter in September 2020 that CMS would withdraw MFAR, citing “concerns that have been raised by our state and provider partners about potential unintended consequences of the proposed rule, which require further study.” MFAR was officially withdrawn in January 2021.

The law requires the Secretary of the Department of Health and Human Services (HHS) to establish a reporting system for each state that authorizes supplemental payments in its Medicaid State plan by the by October 1, 2021. All reports must be publicly posted on the CMS website.

The reporting required by the new law is not as extensive as had been proposed under MFAR, but the new administration will have some discretion when developing the reporting system. The state reports would need to explain the purpose and intended effects of their Medicaid supplemental payments, including how the payments are consistent with federal Medicaid requirements related to efficiency, economy, quality of care, and access to services. The reports will also describe the providers eligible to receive supplemental payments and the methodology used to calculate and distribute the payments. Finally, the reports must include assurances that total Medicaid payments to an inpatient hospital will not exceed federal upper payment limits, including a demonstration of compliance with applicable upper payment limits.

The law defines a supplemental payment as “a payment to a provider that is in addition to any base payment made to the provider” under the Medicaid State plan or a Medicaid demonstration authority, other than Disproportionate Share Hospital payments. Although this definition sweeps broadly, it does invite questions about whether certain state Medicaid payments are properly characterized as supplemental or base payments. Further, the bill only requires reporting as a requirement for making supplemental payments under a state’s Medicaid plan, raising the possibility that payments authorized under a waiver or demonstration program could be treated differently.

The new reporting system will help advance federal goals of improving the oversight and transparency of Medicaid supplemental payments, and could result in additional scrutiny being applied to those payments. Health care providers that receive Medicaid supplemental payments should carefully watch for forthcoming guidance on the new reporting system and be prepared to work with their state to submit required information.

Clipped from: https://www.natlawreview.com/article/congress-requires-new-medicaid-payment-reporting

MM Curator summary

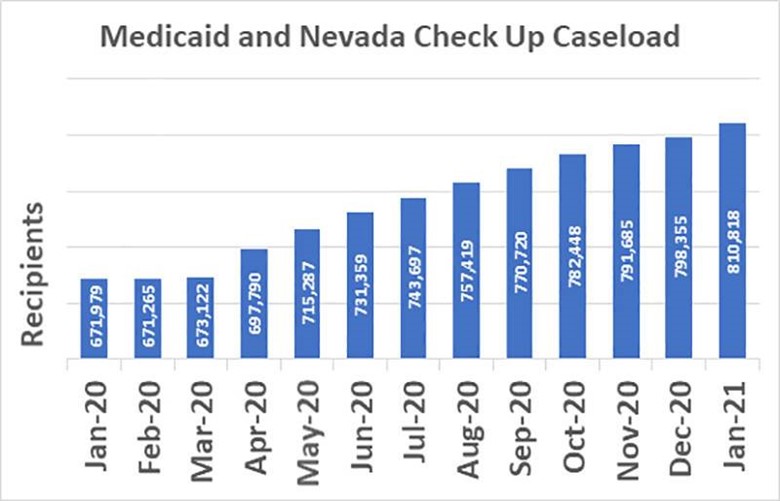

Nevada has a new record for Medicaid enrollment, and its nearly 15% higher than the previous record

The article below has been highlighted and summarized by our research team. It is provided here for member convenience as part of our Curator service.

Medicaid and Check Up are now serving a record number of people, surpassing 800,000. The previous record was set in 2018 at over 690,000.

Nevada Medicaid, the state- and federally funded health insurance program, has hit record enrollment, with one out of every four Nevadans currently being served by the program.

Medicaid and Check Up are now serving more than 810,000 Nevadans, and the increase is attributed to the pandemic and subsequent economic downturn.

“Medicaid services are always available, and people continue to reach out to us in their time of need,” Nevada Medicaid Administrator Suzanne Bierman said. “The fact is, when more people need assistance, Nevada Medicaid enrollment goes up.”

The previous record enrollment was 690,596 set in August 2018. Enrollment is expected to continue to climb with a new open enrollment period from Feb. 15-May 15 through Nevada Health Link, which opened up in response to an executive order from President Joe Biden.

Nevada Medicaid offers assistance for people who have lost their job or become too sick to work; supports minimum wage workers, low-income families, children, seniors and people with disabilities; offers financial protection for working families so that they do not face bankruptcy when struck by unexpected illness or suddenly need to go to the hospital; and makes health care possible in many rural communities.

To get started, apply at https://accessnevada.dwss.nv.gov/

Those whose incomes are slightly too high to qualify for Medicaid are encouraged to apply through Nevada Health Link, where residents may be eligible to receive financial assistance through subsidies or tax credits to help pay for monthly premiums. For more information, visit NevadaHealthLink.com or call 1-800-547-2927.

Clipped from: https://pvtimes.com/news/nevada-medicaid-enrolls-record-810000-residents-96111/