Category: Monthly News Roundtable

Our monthly show where a rotating panel of experts covers the Medicaid industry news in the last 30-45 days. Articles in this category here are covered in the show.

Clay’s Monthly Medicaid News Roundtable: Episode 54

Monthly Medicaid News Roundtable: Episode 51 with Gary Jessee and Elena Nicolella

Medicaid News Roundtable- Episode 49

Medicaid News Roundtable- Episode 48

Monthly Medicaid News Roundtable: Episode 47

Monthly Medicaid News Roundtable: Episode 46

Magellan Rx Management Releases Fifth Annual Medicaid Pharmacy Trend Report

Curator, Rx, Roundtable show

The article below has been highlighted and summarized by our research team. It is provided here for member convenience as part of our Curator service.

Curator summary

Roughly half of Medicaid spending is on specialty drugs based on this 25-state study.

Clipped from: https://news.yahoo.com/magellan-rx-management-releases-fifth-113000880.html

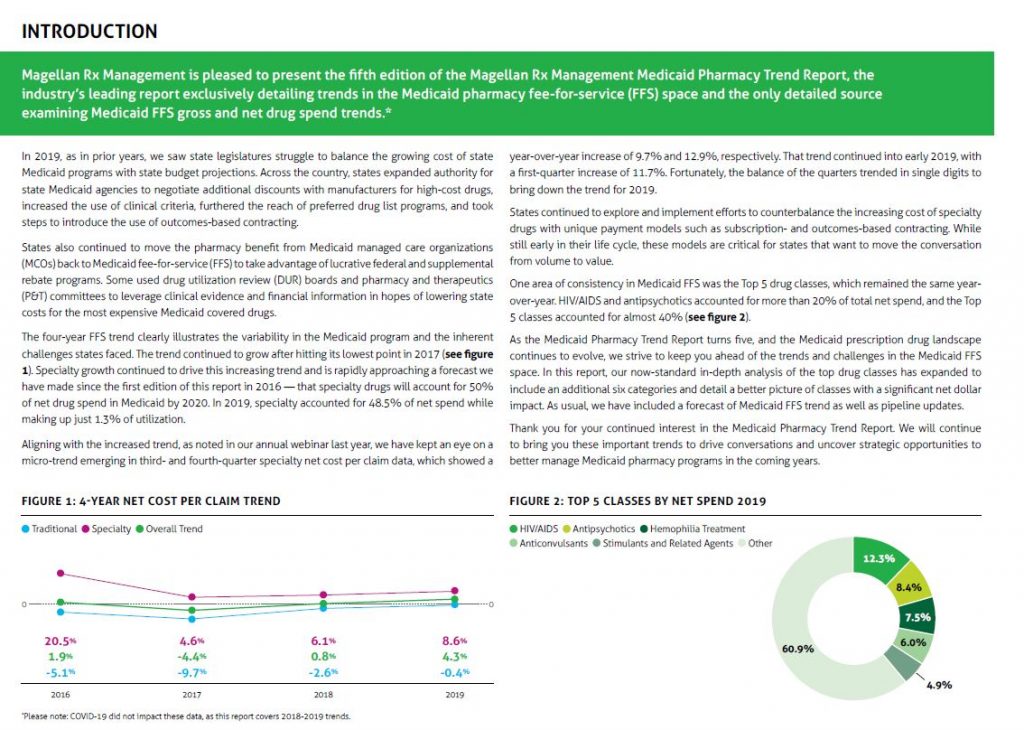

Magellan Rx Management, the full-service pharmacy benefits management division of Magellan Health, Inc. (NASDAQ: MGLN), released its fifth annual Medicaid Pharmacy Trend ReportTM, the industry’s leading report exclusively detailing trends in the Medicaid pharmacy fee-for-service (FFS) space and the only detailed source examining Medicaid FFS gross and net drug spend trends.

“As a national leader in pharmacy benefit management, with more than 40 years of experience, we maintain a deep understanding of the complexities within the Medicaid space related to prescription drug costs and utilization trends,” said Meredith Delk, PhD, MSW, general manager and senior vice president, government markets, Magellan Rx Management. “The Medicaid Trend Report is one tool of many we deploy that provides value to our more than 25 government customers and Medicaid agencies across the country. We are delighted to release it for the fifth consecutive year.”

Developed through in-depth data analysis and supported by Magellan’s broad national experience managing Medicaid FFS pharmacy, the Medicaid Pharmacy Trend Report highlights the evolving landscape of Medicaid prescription drugs and anticipates the trends and challenges in the Medicaid FFS space. The report also now includes a standard in-depth analysis of the top drug classes including six additional categories that provide a superior overview of classes with significant net dollar impact.

Key findings in this year’s report include:

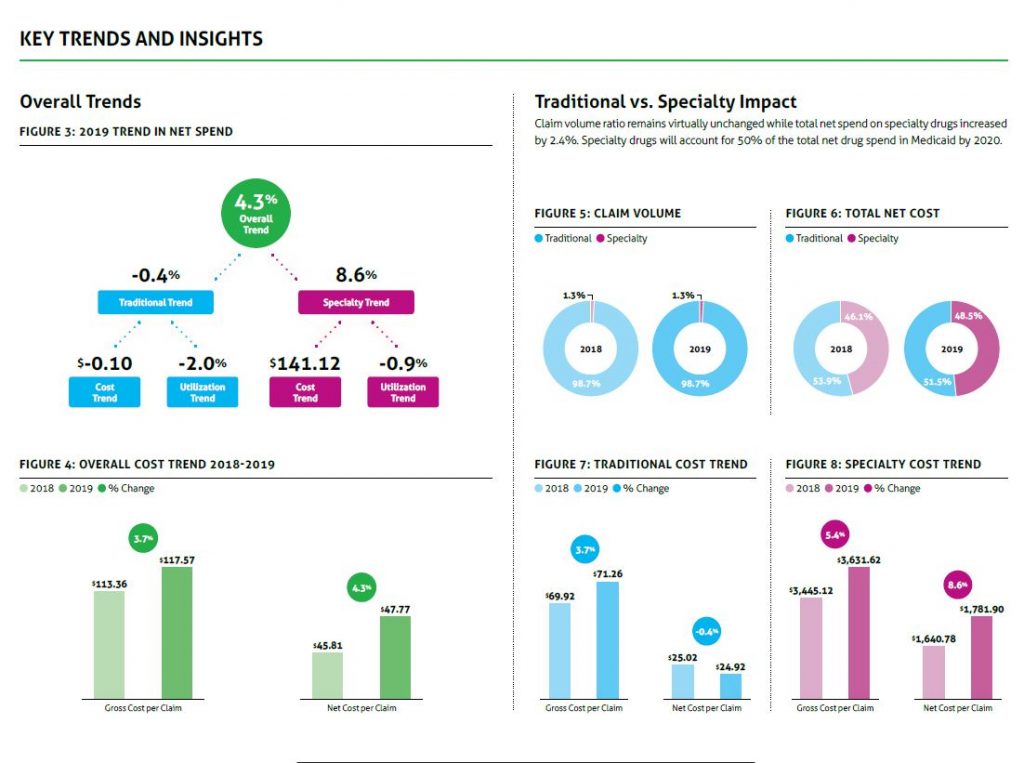

- In 2019, specialty drugs accounted for 48.5 percent of net cost in Medicaid while making up just 1.3 percent of utilization.

- Traditional net spending on drugs decreased 0.4 percent from 2018 to 2019.

- Unit cost, not utilization, drove specialty trend in 2019. The net cost per claim increased by $141.12, while utilization decreased by 0.9 percent.

- While claim volume remains virtually unchanged, the total net spend on specialty drugs increased by 2.4 percent which indicates that specialty drugs will account for 50 percent of total net spend for 2020.

“States are faced with inherent challenges related to the variability in the Medicaid program due to fluctuations in enrollment, enabling legislation and pharmacy program design,” said Chris Andrews, Pharm.D., vice president, value-based purchasing, Magellan Rx Management. “The Medicaid Trend Report clearly illustrates critical data-driven observations and helpful solutions that can assist states as they continue to explore and implement efforts to balance the growing cost of state Medicaid programs with state budget projections as they focus on achieving improved outcomes for Medicaid patients.”

The Magellan Rx Management Medicaid Pharmacy Trend Report includes data derived from Magellan Rx’s Medicaid FFS pharmacy programs in 25 states and the District of Columbia.

About Magellan Rx Management: Magellan Rx Management, a division of Magellan Health, Inc., is shaping the future of pharmacy. As a next-generation pharmacy organization, we deliver meaningful solutions to the people we serve. As pioneers in specialty drug management, industry leaders in Medicaid pharmacy programs and disruptors in pharmacy benefit management, we partner with our customers and members to deliver a best-in-class healthcare experience.

About Magellan Health: Magellan Health, Inc., a Fortune 500 company, is a leader in managing the fastest growing, most complex areas of health, including special populations, complete pharmacy benefits and other specialty areas of healthcare. Magellan supports innovative ways of accessing better health through technology, while remaining focused on the critical personal relationships that are necessary to achieve a healthy, vibrant life. Magellan’s customers include health plans and other managed care organizations, employers, labor unions, various military and governmental agencies and third-party administrators. For more information, visit MagellanHealth.com.

(MGLN-GEN)

View source version on businesswire.com: https://www.businesswire.com/news/home/20201113005178/en/

Contacts

Media Contact: Lilly Ackley, ackleyl@magellanhealth.com, (860) 507-1923

Investor Contact: Darren Lehrich, lehrichd@magellanhealth.com, (860) 507-1814

Kentucky Medicaid court case heads to mediation with several hurdles – Louisville Business First

Curator, KY, Managed Care, Roundtable Show

Clipped from: https://www.bizjournals.com/louisville/news/2020/11/18/medicaid-mediation-starts-at-loggerheads-over-memb.html

The article below has been highlighted and summarized by our research team. It is provided here for member convenience as part of our Curator service.

Curator summary

KY MCO lawsuits continue, but with a focus on mediation by early December.

Court documents show that there are hurdles just to get mediation in the case over how the state awarded its Medicaid contracts started.

Mediation among the eight organizations at the heart of the controversy surrounding the state’s Medicaid program has started off with conflicting visions for the process.

Court documents filed on Friday show differing views on matters such as timing, how to handle a pending motion in Franklin Circuit Court and disputes over a proposed precondition to the outcome of mediation.

On Nov. 12, Franklin Circuit Court Judge Phillip Shepherd ordered that the two government agencies and six Medicaid companies in the suit try to resolve the matter through mediation and to set a date to do so before Dec. 12.

Under dispute

The two government agencies — the Kentucky Cabinet for Health and Family Services and the Finance and Administration Cabinet — filed a joint status report with Medicaid companies: Aetna Better Health of Kentucky Insurance Co., Anthem Kentucky Managed Care Plan Inc. and Molina Healthcare of Kentucky Inc. in which they proposed a mediator: John Van Winkle of Indianapolis-based Van Winkle Baten Dispute Resolution.

They also hope to set a mediation date of no sooner than the week of Nov. 30 and no later than the court-mandated Dec. 12, the report reads. But UnitedHealthcare of Kentucky Ltd. and Humana Health Plan Inc. want to see mediation no later than or on Nov. 26, Thanksgiving, according to a joint status report that also included WellCare Health Insurance Company of Kentucky.

UnitedHealthcare brings one of the most specific demands to the table before the mediation takes place.

“[P]rior to the mediation and included with each party’s mediation statement, each [Medicaid company] must acknowledge a willingness to permit reassignment of its membership,” UnitedHealthcare states.

WellCare and Humana reject the precondition of the Medicaid companies forfeiting members, which is a major sticking point for the lawsuit that preceded the order for mediation. The two government agencies and Aetna, Molina and Anthem reject any preconditions to the mediation talks.

How we got to this point

On Oct. 23, Judge Phillip Shepherd ordered that the state must allow Anthem to remain in the Medicaid program, expanding the number of participant companies from five to six, despite Anthem’s inability to win a contract in two RFP process in the last year.

In court, UnitedHealthcare filed a motion calling for Shepherd to amend his order to release the state from providing a contract to Anthem and to eliminate Molina Healthcare from the program and assign the members of the two companies to United.

With Anthem remaining in the Medicaid program and Molina taking over Passport’s members, UnitedHealthcare contends that there won’t be enough members in the program to make it viable or enough members for the state to meet its contractual obligation to provide enough members to help new Medicaid companies get started.