Many of our clients are solution vendor professionals working in the health and human services space (including the full spectrum of solution verticals selling in this space). The article below is based on our experience working with sales teams who have best-in-class capture processes.

Reading time: 15-minutes

Intended audience: Information Technology or Solution Business Development or Governmental Affairs Team Members in HHS solution vendors companies

Key Topics: Overview of HHS/Medicaid sales cycle, Comparison to other verticals, Fee for Service vs. Managed Care, Main stages of procurement cycle, Timelines

Overview of the Medicaid industry sales cycle

This article will cover the high level overview of the sales cycle for opportunities in the health and human services (HHS) space, including:

- How the Medicaid sales cycle differs from other healthcare verticals (comparing to commercial and Medicare)

- The two major paths of the Medicaid sales cycle: Fee For Service vs managed care

- The typical procurement cycle

- Detecting opportunities pre-RFP

- Duration of RFP periods

- Delays and cancellations

How the Medicaid sales cycle is different from other healthcare verticals

One of the first things sales professionals notice about selling in the Medicaid space is that its different from selling into commercial or even Medicare Advantage environments. In the commercial space, traditional relational-selling techniques are the norm. The Medicare Advantage space can also be highly relational-selling, but brings with it the added regulatory component that makes it more similar to selling in the Medicaid space.

Selling into the Medicaid space is very different because of 2 major factors:

- Relational selling is trumped by regulatory and process acumen– While your network of contacts is important, most opportunities in this space are driven by formal procurement cycles. The sales team that is more versed in Medicaid and HHS procurement approaches will be more successful than the team with “stronger” contacts but without the Medicaid sales knowledge.

- Value propositions are complicated by a more diffuse decision-making process AND the healthcare complexity of the Medicaid population– While you may be able to engage only a few key decision makers in a commercial (or Medicare Advantage) sale, Medicaid/HHS sales will involve multiple business units inside a health plan (or government agency) and multiple levels of staff. Your sales efforts will touch the C-Suite, but will also include many other parts of the organization. This is because of the extensive regulatory environment, but also because the Medicaid member populations being served by your solutions are much more complex than those in commercial or Medicare Advantage plans.

The 2 major paths of the Medicaid sales cycle: Fee for Service vs Managed Care

Depending on the scale of your solution, you may want to sell either to state agencies or Medicaid managed care plans. (There are some instances in which both capture paths might make sense). State agencies typically make very large purchases of technology solutions that will be used by all providers in the Medicaid program in their state (such as claims processing systems). Managed care plans typically purchase solutions that will be used for the operations of their plans and programs only.

Reasons to focus your sales efforts on Medicaid managed care

Many solution vendors find the unpredictability, complexity and length of the direct-to-states sales path too difficult, so they quickly pivot into the Medicaid managed care capture path. The styles used to sell to commercial targets are also similar to those used to sell to Medicaid managed care plans. Because of these reasons, solution vendors typically focus on Medicaid managed care at least in the beginning of their Medicaid sales efforts.

Reasons to focus your sales efforts on state agencies

There are two main reasons to focus on sales to state agencies:

- Your solution is so large that it is not something a single plan (or even multiple plans) can purchase, or

- Even if your solution is not too large for a single plan buyer, you may want to sell to agencies to get your solution to be preferred or required for all managed care plans

The Main Stages of the Typical Procurement Cycle

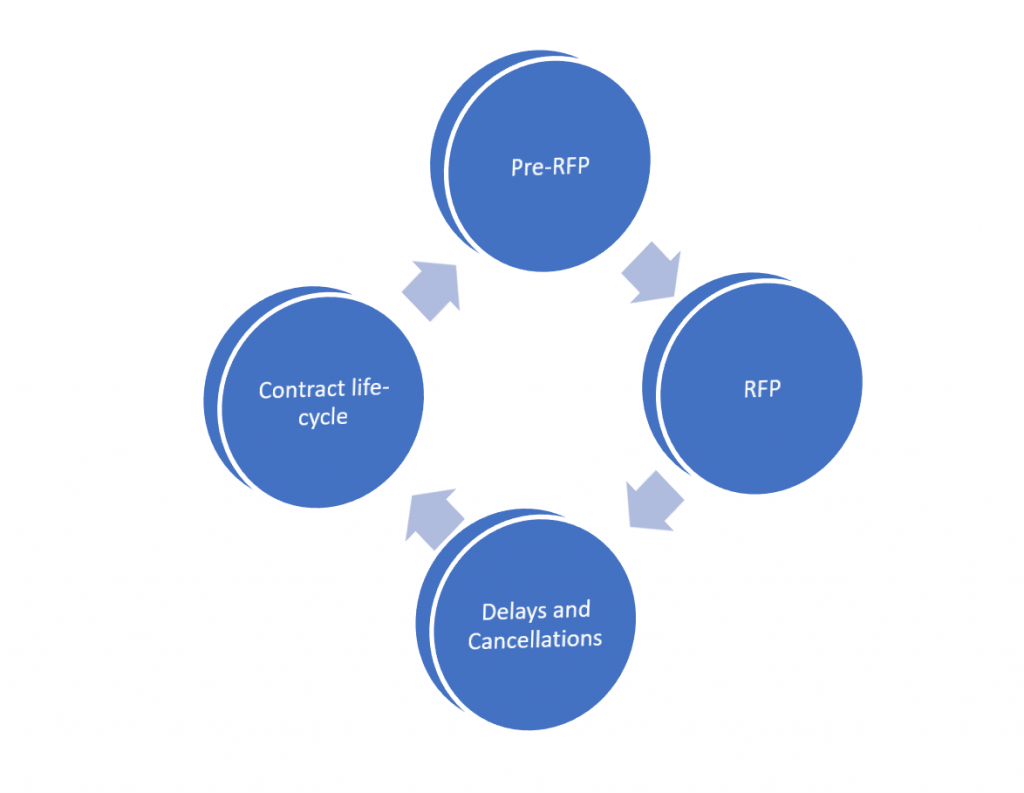

The Medicaid sales cycle can be broken down into 4 main stages as shown in this diagram:

Detecting opportunities pre-RFP

The single most important part to get right

It is important to detect procurement opportunities before an official request for procurement is announced for 3 main reasons:

- By the time the procurement is announced it may be primed for a specific vendor

- Early detection places you in an advantage for proposal preparation (bidders often have less than 30 days to prepare large proposal packages)

- If you detect an opportunity early enough, you can provide input into the overall strategy

The RFP Stage – Expect the unexpected

Duration of RFP periods

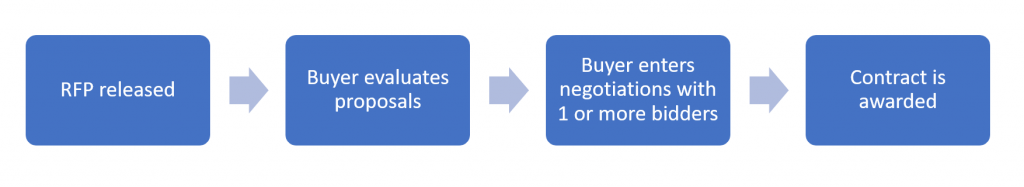

While RFP timelines vary for each procurement, a typical RFP in the Medicaid space will take about 3 to 6 months from the time the RFP is released.

The major stages are:

- RFP is released, proposals are prepared– You should plan on about 30 days for the time allowed to respond to an RFP.

- The buyer (state or health plan) reviews submitted bids– Initial decisions take another 30 days or longer. If there are multiple bidders who make it past the initial vetting, this stage can take longer and evolve into an extensive best-and-final offer (BAFO) model.

- The winning bidder and the buyer establish the actual contract- Contract negotiations add another 30- 60 days. Buyers often select 2 vendors to enter preliminary negotiations with, and this stage can add additional time and revisions.

Besides the normal timelines observed, there are other ways more time can be added to the process. One of the most common ways this can happen is through the vendor Q and A process. When buyers collect questions from vendors, there are often items of scope that are clarified or changed. In some cases, the buyer will issue an addendum which can allow for more time to accommodate the change in proposals.

Delays and cancellations

It happens more often than any of us prefer

Delays can be caused by many factors, including:

- CMS approvals take longer than expected (for the federal share)

- The vendor review and approval process takes longer than expected

- BAFO / contract negotiations takes longer than expected

Cancellations can happen for a variety of reasons, including:

- Budget authority may be pulled by the state legislature

- Another program initiative takes priority

An incumbent offered the solution as part of an amendment to their existing scope

How You Can Optimize Your Sales Capture Approach to the Unique Medicaid Industry Sales Cycle

In addition to your own research into this vertical, there are a few key tactics that can help you overcome some of the common challenges in the space.

- Target your capture strategy to the appropriate Medicaid path-The tactics used in the 2 major paths are very different, and it is important to prioritize based on which path you feel is right for your near and long term goals. If your value proposition is refined enough, it should be clear which path is best. The maturity of your solution can also help guide this choice.

- Engage a firm with deep expertise and extensive contacts in the space to accelerate your efforts and train sales staff. We provide this type of assistance to our technology solution vendor clients, and are happy to have a conversation anytime. If our services and expertise are a fit for your needs as you develop or execute your strategy, engaging with us is a simple process. If we are not the right fit, we are happy to make a referral to another firm who may be.

- Improve your ability to surface opportunities before they go out to bid- In Medicaid, you must know each state market in-depth to be able to identify opportunities earlier. If you have an in-house market intelligence team, they can track state budget bills and legislation. They can research MMIS contract cycles to gauge when large changes to technology spending will occur. On the managed care side, your team can stay on top of Medicaid waiver applications with CMS to predict when plans may need help with new scope. You can also research MCO contracts to understand key timelines. Your team can review EQRO reports and related PIPs to identify specific pain points for an MCO. We also provide state-level tracking for opportunity detection for clients, and are happy to discuss at any time.

- Consider adding a Medicaid-specific sales intelligence product to your toolkit. While there are multiple options for general sales intelligence in the healthcare space, if you are considering (or already executing) a sales strategy tied to Medicaid or HHS-vertical revenues, the more specific your research sources, the better. Our HHS GreenBook combines extensive RFP collection with copies of incumbent proposals, contracts and in depth state market profiles.