What are some tips on how to achieve them?

Many of our clients are state government professionals working in health and human services agencies (including the full spectrum of the human services enterprise). The article below is based on our experience working with professionals in this space.

Reading time: 10 mins

Intended readers: State HHS staff considering or designing an organizational change project.

You may have noticed a trend in recent years of state organizations hiring outside experts to come in and assess their organizational structure and processes. As more and more of our state clients seek to benefit from similar efforts, we wanted to provide some observations to help you as you consider organizational transformation projects. Each agency will have its own unique goals, but there are a few common ones we have observed in recent years.

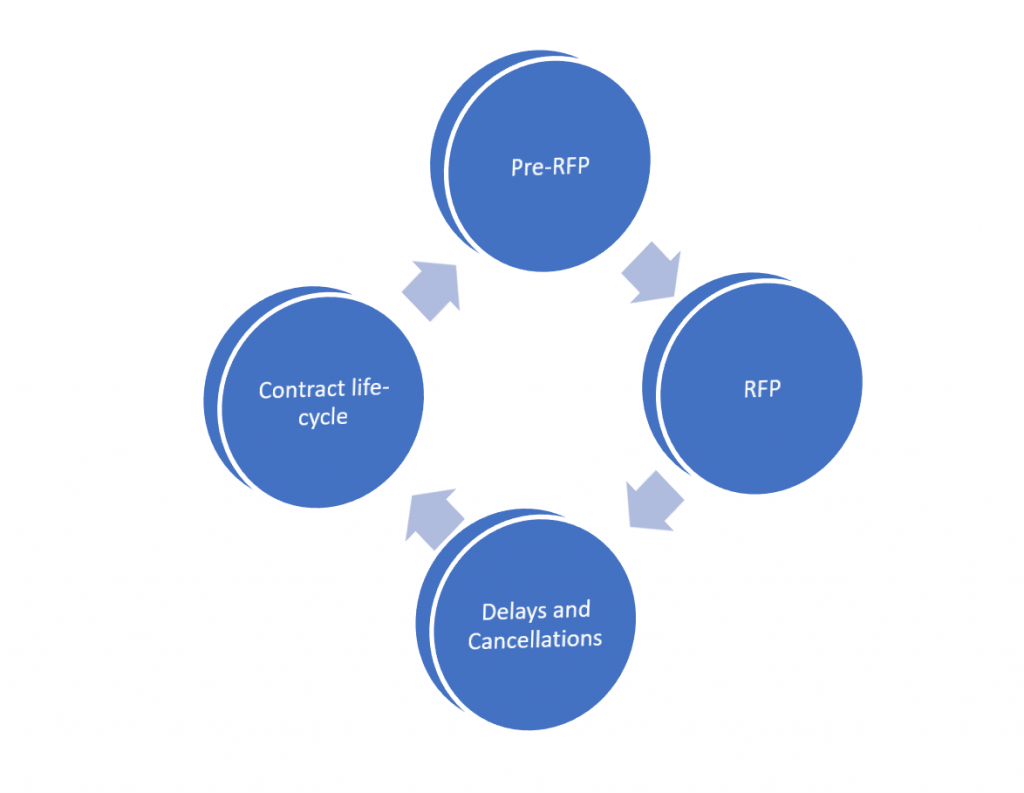

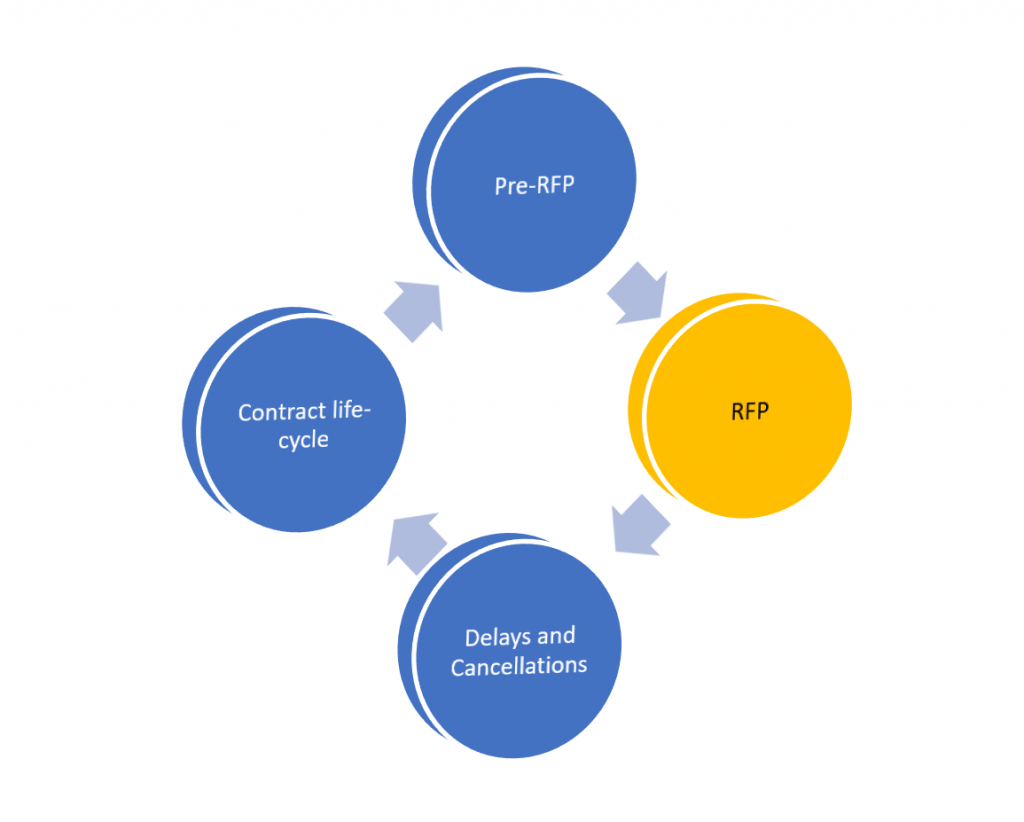

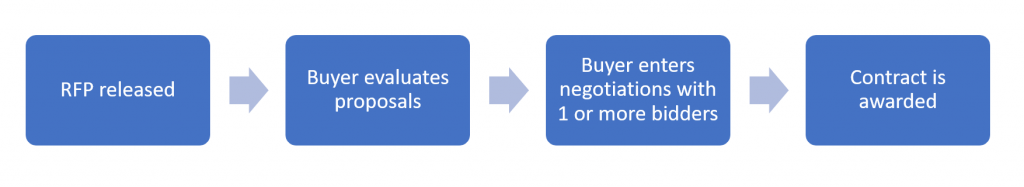

Goal 1 – Use a process improvement project to streamline service delivery

State organizations recognize that their service delivery is often “siloed”, with elements housed in multiple different divisions or departments. These siloes are apparent whenever overlapping benefits programs are reviewed. The recent focus on social determinants has also driven a new effort to integrate human services, and opportunities to observe these siloes have increased.

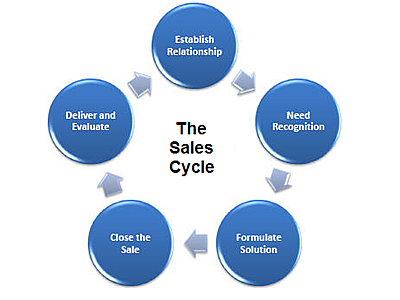

Because the delivery of services involves so many different parts of a Medicaid agency, including vendor management, provider networking enrollment systems, and quality reporting, this type of project can get complicated quickly. States realize that improving the delivery of a specific service will require a focus on broader organizational re-alignment to meet this goal.

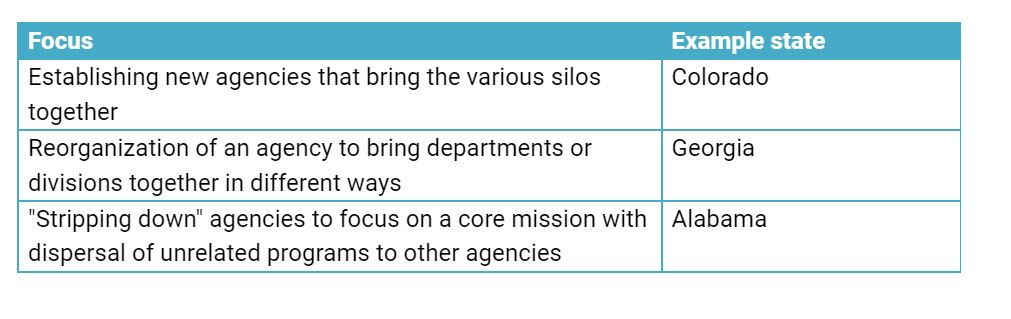

Examples of efforts to improve service delivery using an organizational change project include:

Goal 2 – Improve alignment of Part 2 Provider Manuals policies for a specific population or service type

Streamlining benefits within a single HHS agency – An easy, early win

State organizations often have a strained oversight role given their policy and operational responsibilities for multiple different departments and a wide range of programs. The effort to keep related provider and member policy documents updated can consume an extraordinary amount of agency time. This can be especially true if a state regulatory framework includes legislative review of benefits policy changes.

While many agencies have made great progress in streamlining policy development within their own program portfolio, if yours has not, this can be a great way to energize an organizational transformation project.

Medicaid delivers benefits using categories of services that often overlap. For example, many of the billable codes for the physician’s services category can also be found in the manuals for advanced nurse practitioners. Or manuals for physician assistants. Or telehealth. Each of these programs will have different rules around prior authorization and coding (such as modifiers).

Keeping all these policies up to date and not in conflict can be challenging. The first step towards improving is to make sure you have a team lead over each major service area. For example, you can have a maternal and child health policy lead that is involved in policy development for OB services, EPSDT and your pregnancy medical home. That person can work with the policy leads for each of those programs to ensure the policies create as little obstacles for members and providers to access services as possible.

Once you have a cross-program policy lead for similar service categories, the next step is to implement a consistent method of updating policy manuals (the Part 2 provider manuals). While most agencies have certain changes that require public comment or fiscal analysis, many changes do not fall under those rules. It is important to understand how each of your policy units are making these changes, and on what schedule. Once you have a handle on this, you can work to make them as similar as possible, which will help with downstream efforts like provider education and changes to your MMIS systems.

Goal 3 – Improve alignment of sister agency benefits policies for a specific population or service type

Challenges streamlining benefits policies across multiple HHS agencies- A longer term investment with big payoffs

We often see significant challenges when a single commissioner or director does not have oversight authority over all programs that deliver similar services to beneficiaries. For example, the child welfare agency will serve children in foster care, but so will the Medicaid agency. Each agency will have it’s own detailed benefit and service manuals for physical health, behavioral health and pharmaceutical benefits for this population.

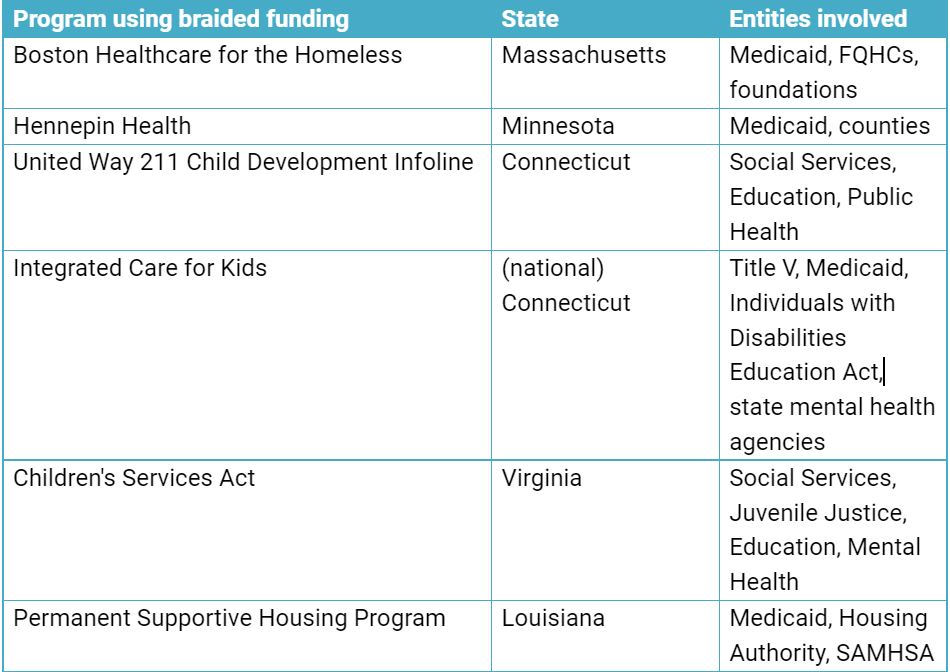

Integrated eligibility system projects have highlighted many of these conflicts and gaps. As agency staff collaborate to simplify the eligibility pathways for members, they are also having a-ha moments about overlaps in benefit packages. Streamlining eligibility is an important first step, but removing conflicting requirements in the service policy framework offers an entirely new opportunity area to maximize the delivery of human service benefits. Efforts to achieve “braided funding” across HHS agencies have also helped bring awareness to these challenges.

Goal 4 – Improve customer experience within an agency or service line

Sometimes the biggest opportunity to improve HHS operations is by improving customer service provided to members. We have seen agencies increasingly focused on the “citizen experience.” However, trying to align old structures with new ways of interacting with members can be difficult.

State agencies are challenged to provider members with a similar experience as they receive in the consumer marketplace more generally. For example, Medicaid members also interact with cell phone providers, banking providers and a range of other service providers in an increasingly online environment. These models provide more and more opportunities for the customer to direct their own service and solve their own issues using AI and similar help tools. When those same customers interact with an HHS program that uses an outdated approach to customer care, the differences can be dramatic.

Transitioning more activities to self-service, rather than requiring intervention by state staff can be daunting. While this has a technical component (see also our other articles on trends in improving state website design), there is a significant “offline” transformation effort needed to move agency units that have traditionally been insulated from public-facing efforts to being more closely connected to the end user of the service.

How You Can Address the Challenges of Improving Your Agency’s Organizational Model

We help a range of state agency clients navigate these challenges, and are happy to discuss supporting your efforts at any time.

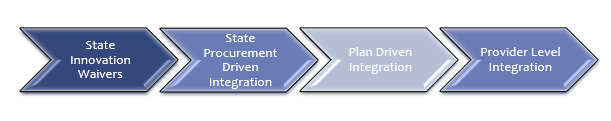

Besides your own research into this topic, there are a few key tactics that can help you overcome some of the common challenges related to integration of behavioral health and physical health functions:

- First conduct a simple internal review to surface concerns your staff have about an organizational change project AND to get some great ideas for focus areas– An organizational transformation project will create anxiety for many team members. It can be helpful to begin by collecting perspectives in a more casual format first. A few starter questions include: What do your staff like about the way business units interact with each other currently? What do they not like? If they had a magic wand to improve customer service, what is the first thing they would do? How do your staff define customers?

- Begin with the end-user experience as your project design focus. When you take on an organizational change project for a complicated, large HHS agency, it can be easy to lose sight of the HHS members and providers you are serving. As you design your project, maintain laser-focus on the end-users: program members and the providers who serve them. Find ways to keep this focus in all your workstream analyses, policy reviews and project discussions.

- Identify your top 3 customer types and the top 3 services each of them get from you today- Remember you are not starting from scratch, and not everything has to be overhauled. There are hundreds of thousands (or millions, depending on your state) of members who are receiving services from your program today. Do a high level analysis of the main categories of members and providers, and the main things they need your help with.

- Begin an inventory of current workflow solutions being used across your departments today– Almost all organizational change projects result in a set of new investments in workflow technologies. Go ahead and start a simple list of the major ones you are using today.

- Identify overlapping policy manuals within your control– Create a grid of provider types and all the different Part 2 provider manuals they can bill in. Use this grid to conduct initial planning discussions with your policy unit staff for optimization.

- Conduct an initial workflow mapping pilot project in a small unit– Your project will eventually get into extensive workflow mapping exercises. Pick a smaller unit that is not as connected to other units, and test out how your staff like to conduct these types of exercises. When you scale up to a larger project, you will have already enhanced your process and reduce unnecessary challenges.

Reach out