MM Curator summary

The article below has been highlighted and summarized by our research team. It is provided here for member convenience as part of our Curator service.

[MM Curator Summary]: Doctors have to pay a fee to get paid.

Clipped from: https://www.propublica.org/article/the-hidden-fee-costing-doctors-millions-every-year

Credit: Alvaro Bernis for ProPublica

A powerful lobbyist convinced a federal agency that doctors can be forced to pay fees on money that health insurers owe them. Big companies rake in profits while doctors are saddled with yet another cost in a burdensome health care system.

ProPublica is a nonprofit newsroom that investigates abuses of power. Sign up to receive our biggest stories as soon as they’re published.

It was a multibillion-dollar strike, so stealthy and precise that the only visible sign was a notice that suddenly vanished from a government website.

In August 2017, a federal agency with sweeping powers over the health care industry posted a notice informing insurance companies that they weren’t allowed to charge physicians a fee when the companies paid the doctors for their work. Six months later, that statement disappeared without explanation.

The vanishing notice was the result of a behind-the-scenes campaign by the insurance industry and its middlemen that has largely escaped public notice — but that has had massive financial consequences that have rippled through the health care universe. The insurers’ invisible victory has tightened the financial vise on doctors and hospitals, nurtured a thriving industry of middlemen and allowed health insurers to do something no other industry does: Take one last cut even as it pays its bills.

Insurers now routinely require doctors to kick back as much as 5% if they want to be paid electronically. Even when physicians ask to be paid by check, doctors say, insurers often resume the electronic payments — and the fees — against their wishes. Despite protests from doctors and hospitals, the insurers and their middlemen refuse to back down.

There are plenty of reasons doctors are furious with the insurance industry. Insurers have slashed their reimbursement rates, cost them patients by excluding them from their provider networks, and forced them to spend extra time seeking pre-authorizations for ever more procedures and battling denials of coverage.

Paying fees to get paid is the final blow for some. “All these additional fees are the reason why you see small practices folding up on a regular basis, or at least contributing to it,” said Dr. Terence Gray, an anesthesiologist in Scarborough, Maine. Some medical clinics told ProPublica they are seeking ways to raise their rates in response to the fees, which would pass the costs on to patients.

“It’s ridiculous,” said Karen Jackson, who until her retirement in March was a veteran senior official at the Centers for Medicare & Medicaid Services, the federal agency that posted, then unposted, the fee notice. Doctors, she said, shouldn’t have to pay fees to get paid.

But that’s precisely what’s happening. Almost 60% of medical practices said they were compelled to pay fees for electronic payment at least some of the time, according to a 2021 survey. And the frequency has increased since then, according to medical clinics. With more than $2 trillion in medical claims being paid electronically each year, these fees likely add up to billions of dollars annually.

Huge sums that could be spent on care are instead being siphoned off to insurers and middlemen. The fees can cost larger medical practices $1 million a year, according to an April poll by the Medical Group Management Association, which represents private medical practices. The figure sometimes runs even higher, according to a 2020 complaint to CMS from a senior executive of AdventHealth, which has 53 hospitals in nine states: “I have to pay $1.8M in expenses that I could use on PPE for our employees, or setting up testing sites, or providing charity care, or covering other community benefits.” Most clinics are smaller, and they estimated annual losses of $100,000 or less. Even that figure is more than enough to cover the salary of a registered nurse.

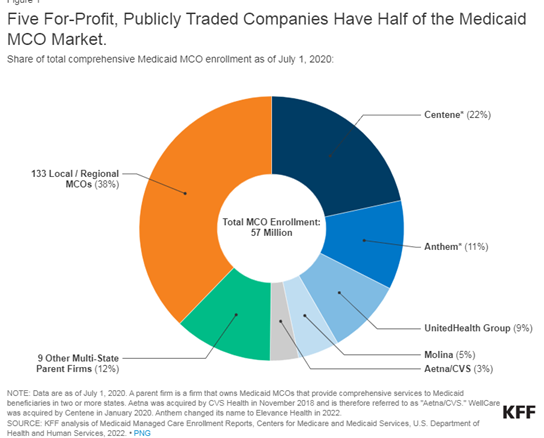

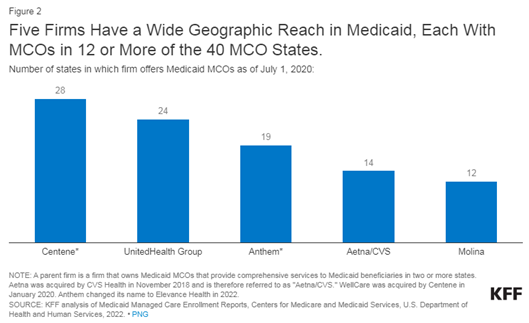

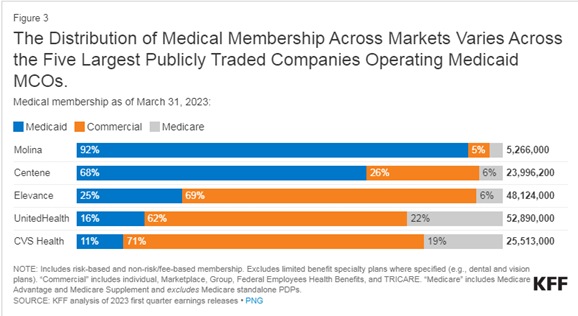

The shift from paper to electronic processing, which began in the early 2000s and accelerated after the Affordable Care Act went into effect, was intended to increase efficiency and save money. The story of how a cost-saving initiative ended up benefiting private insurers reveals a lot about what ails the U.S. medical system and why Americans pay more for health care than people in other developed countries. In this case, it took less than a decade for a new industry of middlemen, owned by private equity funds and giant conglomerates like UnitedHealth Group, to cash in.

How these players managed to create this lucrative niche has never previously been reported. And the story is coming to light in part because one doctor, initially incensed by the fees, and then baffled by CMS’ unexplained zigzags, decided to try to figure out what was going on. Dr. Alex Shteynshlyuger, a urologist who runs his own clinic in New York City, made it his mission to take on both the insurers and the federal bureaucracy. He began filing voluminous public records requests with CMS.

Dr. Alex Shteynshlyuger is on a crusade against payment processors’ fees, which he says threaten his practice. Credit: DeSean McClinton-Holland for ProPublica

What he discovered in internal emails and government documents, which he shared with ProPublica, was a picture sharply at odds with the image of CMS as a hugely powerful force in health care. The records showed, again and again, federal officials deferring not only to a single company, but to a single executive.

Over the past five years, CMS adopted that company’s positions on fees. Shteynshlyuger discovered that, when it comes to the issue he cares about, the most powerful decision-maker wasn’t a CMS official. It was the chief lobbyist for a middleman company called Zelis. And that man just happened to be a former CMS staffer who had authored a key federal rule on electronic payments.

For Shteynshlyuger, the intersection of medicine and money has a particular resonance. He was born in the Soviet Union, in what is now Ukraine, and his brother nearly died of pneumonia as an infant because doctors refused to administer an antibiotic. The doctors wanted his family to pay a “bribe,” according to Shteynshlyuger. His grandmother ended up finding a different doctor to pay off and his brother got the medicine. Shtenynshlyuger’s parents emigrated to the U.S. in 1991, when he was an adolescent, and they settled in Brooklyn’s Brighton Beach area.

Today, Shteynshlyuger sees the fees for electronic payment through a similar lens. He’s a gadfly, but one with a wry, sometimes humorous disposition and an intellectual bent. He studied biology and economics in college and is capable of both rage at perceived unfairness and dispassionate observations about health policy. The unjust fees, as he sees them, threaten his medical practice, which he designed to serve middle-class patients. He prices his services at a discount. “Low cost is what keeps me in the business,” he said.

As a result, administrative combat has become a big part of his life. Unmarried, Shteynshlyuger, 45, stays up into the wee hours, writing lengthy memos to regulators. One recent missive spanned 155 pages, including appendices.

This New Year’s, he joined his family for a week off at his parents’ condo near Miami. Shteynshlyuger arrived with a desktop computer, which he set up in one of the bedrooms alongside two monitors that he keeps at the condo. While his nieces and brother enjoyed the beach, Shteynshlyuger sat indoors, drafting a 38-page memo to aid in one of two lawsuits he has filed in an effort to pry documents out of CMS.

Shteynshlyuger’s accent, with its distinctive Brooklyn-Russian mix, is unmistakable in calls with customer service representatives at insurance companies and payment processors. (He recorded many of the calls and shared them with ProPublica.) The calls follow a similar pattern: Posing questions in the manner of a genial but persistent litigator, Shteynshlyuger asks why he’s being charged a fee.

Ultimately, he’s informed that there’s no way to have an electronic funds transfer, or EFT, sent straight to his bank account without paying a fee. When the calls get escalated, representatives sometimes offer to shave a tiny amount off the fees — charging, say, 2.1% rather than 2.5%, a proposal made on one recent call with Zelis — but rarely is he offered a free transfer.

Shteynshlyuger spends hours on the phone with payment processors like Zelis, fighting their attempts to impose fees on electronic payments. Credit: DeSean McClinton-Holland for ProPublica

A spokesperson for Zelis, the payment-processing company that Shteynshlyuger has tangled with most often, said the company refers requests for free electronic payments to the insurers, but recordings and transcripts of recent calls show that did not happen when Shteynshlyuger called.

Shteynshlyuger and other doctors say payment processors routinely sign them up for high-fee payment methods without their consent. A brochure for one payment company, Change Healthcare, boasted of automatically enrolling 100,000 doctors and hospitals in a plan to receive virtual credit cards and sharing some $8 million a year in revenues with the large insurer it was working for. (Virtual credit cards are a form of electronic payment in which a payer sends a string of numbers that are typed into a credit card reader to generate a one-time payment. Fees for VCCs run as high as 5% versus a typical 2.5% for other kinds of electronic payments.)

Payment processors often boost insurers’ revenues by sharing the fees from virtual credit cards. One processor, VPay, says in its marketing materials that insurers can “make money on every virtual card transaction.” In response to questions from ProPublica, UnitedHealth, which owns Change and VPay, asserted that its services help medical clinics streamline recordkeeping, reduce administrative burdens and accelerate payments.

Zelis and other payment processors say they offer value in return for their fees: Doctors can sign up to receive reimbursements from hundreds of insurers through a single payment processor, and they can also get services that help match up electronic payments and receipts. Zelis asserted in a statement that its services remove “many of the obstacles that keep providers from efficiently initiating, receiving, and benefitting from electronic payments.” Zelis and other companies insist that it’s easy to opt out of their services, but Shteynshlyuger and other doctors say otherwise.

Virtual credit cards come with fees as high as 5%. Credit: Courtesy of Dr. Terence Gray. Redacted by ProPublica

When Shtyenshlyuger embarked on his mission of fighting the fees in 2017, his first step was research. He quickly came across an article from the American Medical Association that said the law was on his side.

Shteynshlyuger then approached the companies. He emailed senior executives of Zelis and VPay, asserting that the fees violated CMS rules. The companies denied breaking any rules and wouldn’t budge on the fees.

So Shteynshlyuger started filing complaints with CMS. The responses he received struck him as curious. CMS itself usually didn’t offer an opinion. Instead, it forwarded letters from a Zelis executive named Matthew Albright, who answered Shteynshlyuger’s complaints on at least five occasions. (The agency said this passive approach is part of its “informal” complaint resolution process.)

When Shteynshlyuger pressed a CMS official to articulate the agency’s position after it passed along Albright’s answer, the official wrote that the agency receives the “identical legal response” from Zelis to all such complaints. She added: “They believe that, according to their interpretation of the regulation, they are compliant.”

Shteynshlyuger was flummoxed. Who was Matthew Albright? A quick Google search revealed that Albright had once worked for CMS. That only piqued Shteynshlyuger’s interest. Had Albright been involved in the removal of the CMS notice prohibiting fees?

To Albright, the 2010 passage of the Affordable Care Act was a historic event of a magnitude akin to the moon landing. Then a policymaker with Washington state’s Health Care Authority, Albright was awed by the importance of the looming rewrite of U.S. health care rules. He felt he had to be part of it. “This is the Apollo 11 for regulators,” he recalled thinking, in an interview with ProPublica. “I’ve got to get to D.C. and write regulations.”

Matthew Albright, now chief legislative affairs officer at Zelis, made a series of explanatory videos in his days at the Centers for Medicare & Medicaid Services. Credit: Screenshot via YouTube

Now 55, Albright had unusual training for his new role. Instead of following the typical path through law school, he had studied sacred texts, first at the Pontifical University of St. Thomas Aquinas in Rome and later at Harvard University, where he earned a master’s degree in divinity. Those studies, Albright said, fostered what he called a “scholastic fascination with words and how they’re used to tell people what to do,” whether those words are in the Ten Commandments or the Code of Federal Regulations.

Articulate and cheerful, today Albright can still sound more like a divinity professor than a lobbyist when he describes his current job as studying laws and rules. “Hermeneutics,” he said, “it’s just like Bible study, right? Breaking it down into its understandable parts. And then, frankly, turning around and teaching it or turning around and explaining it in the vernacular, if you will. So I think that most of my job is looking at regulations and reading them and then explaining them to internal and external audiences.”

At CMS, Albright drafted a rule, published in 2012, that laid out standards for paying doctors via electronic funds transfers. The Affordable Care Act required all insurers to offer EFTs and encouraged doctors to accept them, and electronic payments quickly became the go-to method for handling medical claims. A CMS analysis predicted that eliminating the labor of manually processing paper checks and receipts would lead to savings of $3 billion to $4.5 billion over 10 years.

Albright became the agency’s point man on the issue. He looked every bit the government bureaucrat in a gray shirt and dark suit as he extolled the virtues of “administrative simplification” in earnest-but-stiff video segments that emulated a talk show. (Albright also created a personal YouTube channel when he taught a philosophy course. It had bite-sized explanations of, among other things, Kantian ethics — “do not use people” — and Ayn Rand’s philosophy — “selfishness is good.”)

Albright’s work at CMS, by his description, became a “turning point” for health care payments. The shift to electronic funds transfers facilitated the growth of an industry of payment processors. It also made Albright’s skill set very valuable. In 2014, he was recruited to the industry he previously regulated. Two years later, he landed at Zelis. The company had just been created via a merger of four businesses owned by Parthenon Capital, a private equity firm. Zelis is now co-owned by private equity giant Bain Capital and headed by a former Bain partner. (Parthenon declined to comment; Bain referred a request for comment to Zelis.)

Zelis, which once described itself as having a “regulatory-based business model,” touted Albright’s government resume when it hired him as vice president of legislative affairs. Albright said at the time he would “advocate for rational regulatory approaches.”

Rational regulatory approaches, from Zelis’ perspective, included the right to charge doctors for electronic payments. That was a crucial revenue stream for the company, but it could dry up if CMS enforced a rule prohibiting such fees. Who better than Albright, the man who had drafted rules on electronic payments, to help the company navigate the situation?

When Shteynshlyuger began to receive documents from CMS in response to his Freedom of Information Act requests, he was first struck by how deferential CMS officials seemed to be to Albright. In July 2019, for example, as Shteynshlyuger continued to complain about Zelis, a CMS official named Gladys Wheeler contacted Albright. “You may be familiar with Dr. Alex Shteynshlyuger,” Wheeler wrote. “To assist with resolution of the complaints, I have a few questions. Can I send the questions to you, or can you redirect me?” She added, “Just let me know the best approach. Thanks, and take care, Gladys.” (Wheeler did not respond to requests for comment.)

The tone of the conversations between Albright and CMS could be downright chummy. “Should we respond to it as per usual?” Albright asked in another July 2019 email about a new complaint filed by a doctor in Washington state. “Send the Zelis response for documentation purposes,” Wheeler responded in between banter that she and Albright exchanged about Chicago’s winter weather (bad) and architecture (great).

Shteynshlyuger was growing more frustrated. He didn’t understand why CMS had yanked the notice about the prohibition on fees from its website. If his months of effort couldn’t extract clear answers, how could other doctors with less inclination for bureaucratic battle figure out what to do?

What Shteynshlyuger didn’t know was that, less than two years earlier, a lobbying campaign had begun behind the scenes at CMS. The documents that he eventually obtained would provide a rare, nearly day-by-day glimpse into how one lobbyist — Albright — managed to bend the agency to his will with an artful combination of cajoling, argument and legal threats.

On Aug. 11, 2017, CMS’ website had posted the notice that EFT fees were prohibited. Such notices, presented in the form of answers to frequently asked questions, are meant to explain the agency’s complex rules in plain language. CMS based the notice on a rule from 2000 that banned fees in excess of normal telecommunication costs (such as, say, the tiny fractions of a penny to cover the cost of an email) that a doctor would incur if they were receiving the bill “directly” from an insurer.

The notice triggered an immediate protest from Zelis, according to emails and an internal CMS memo. Albright had “multiple conversations” with CMS staff and demanded that the agency revise the notice.

The nub of Albright’s argument was that CMS’ 2000 rule prohibited insurers from charging excessive fees for “direct” transactions. But, he argued, the rule was meant to apply to insurers dealing with doctors. Albright represented payment processors who work for insurers; those weren’t direct transactions between insurers and doctors. Thus, he argued, the fee prohibition couldn’t apply to EFT payments.

CMS, which took months or longer to respond to Shteynshlyuger, quickly complied with Albright’s request and removed the fee notice on Aug. 14, 2017, only three days after it was posted.

CMS published an updated notice in late September 2017. But the agency stood firm on the key point: The new document stated that insurers and payment processors “should not charge providers communications fees” for EFTs.

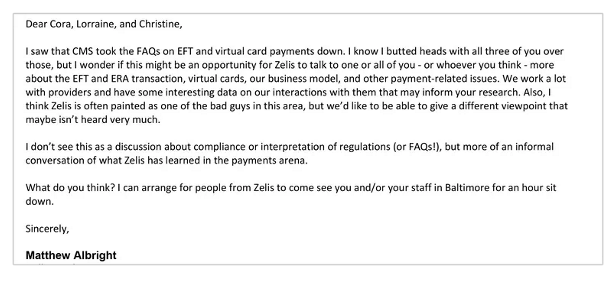

Shortly after the revised notice went up, Albright emailed the director of the CMS division that issued it. “Hope the kids have settled into the school year okay,” he began. He then asked for “our day in court to educate” the agency. He suggested that Zelis was preparing to escalate its complaints but offered to “work through this without causing too much noise.”

Two days before Thanksgiving, Albright confronted Christine Gerhardt, then deputy director of the CMS division that issued the fee notice. In a phone call, Albright demanded that CMS revise the document again, according to Gerhardt’s summary of the call. Gerhardt refused. Albright began debating her on the legal differences between the explainer and the regulation that it summarized.

The following week, Albright pressed harder, asking Gerhardt whether the prohibition on fees was enforceable. He told Gerhardt that if she did not answer, that itself would be an answer. It would, Albright said, “give me a sense of what steps need to be taken next” to challenge the agency’s notice. Gerhardt, who is now retired, said she assured him that the agency wasn’t implementing a new rule; only clarifying existing rules. Albright was pushing hard, but at that point, Gerhardt hadn’t bent.

Then, in January 2018, Zelis brought in the lawyers. A firm called Nixon Peabody wrote to CMS, demanding that the agency “withdraw or correct the offending language” in its notice. Nixon Peabody argued that the fee prohibition wasn’t a restatement of existing rules but that it amounted to a new rule that should have been issued via the formal rulemaking process. Nixon Peabody threatened to sue if CMS didn’t comply with Zelis’ demand. (Nixon Peabody did not reply to a request for comment.)

The legal threat set off a scramble within CMS. “Let’s just take it down,” Gerhardt wrote in a Feb. 9, 2018, email to colleagues. Her division not only removed the notice saying that fees were prohibited but also went so far as to institute a moratorium on any new notices. CMS was essentially depriving all medical providers of guidance on these issues because one company had complained.

The response puzzled even some within CMS. “What was the basis for withdrawal if the request was from a single entity and potentially harms providers?” Jackson, then CMS deputy chief of operations, wrote in an email.

Albright, his goal accomplished, sought to soothe Gerhardt and two of her colleagues. “I know I butted heads with all three of you,” he wrote a few weeks later. Albright offered to meet to explain why Zelis is not “one of the bad guys in this area.” (Zelis did not address detailed questions about Albright’s interactions with CMS.)

In March 2018, after Zelis complained and CMS removed a notice saying that payments to doctors couldn’t carry fees, Albright emailed three key agency staffers to patch things up. Credit: Email exchange provided by Alex Shteynshlyuger

CMS told ProPublica in a statement that it reversed its position because it concluded that it had no legal authority to “flat-out prohibit fees.” The agency declined to comment on Shteynshlyuger’s complaints, but said it takes seriously any allegations of noncompliance with its rules. As for Zelis’ lobbying, CMS said it “receives feedback from a wide range of stakeholders on an ongoing basis. The information received helps the agency understand where guidance and clarification of existing policy may be needed.”

The American Medical Association and over 90 other physician groups have urged the Biden administration to reinstate guidance protecting doctors’ right to receive EFTs without fees. For its part, the massive Veterans Health Administration system has been refusing to pay the fees, which it has described as illegal in letters to Zelis and insurers.

So far the protests have had no visible effect. In fact, when CMS finally issued a new explainer that addressed fees in July 2022, more than four years after erasing the previous one, the agency made explicit what had previously been implicit: EFT fees are allowed.

Shteynshlyuger is continuing his lonely campaign. Two months after CMS stated that fees are OK, a Zelis customer service representative contacted him. Shteynshlyuger had just submitted his 80th complaint to CMS. Emails show the rep offered to help him get signed up for no-fee EFTs — but the offer only applied to payments from one of the more than 700 insurers and other payers that Zelis represents. Shteynshlyuger demurred, saying he did not want the issue resolved without CMS’ intervention because then other doctors could not get the same assistance. As often as not, Shteynshlyuger and other doctors are left with little recourse; many insist on being paid by paper check rather than allowing Zelis to take a cut.

In mid-December, Shteynshlyuger finally got the long-awaited replies to eight other complaints he had filed over the years. CMS dismissed all eight because Shteynshlyuger didn’t file them against insurers but instead against companies like Zelis, which CMS referred to as “business associates” of the insurers. CMS said it now believes its oversight extends only to insurers, not to their business associates. The phrasing may have been bureaucratic, but the news was dramatic: CMS had fully surrendered, giving up on regulating payment processors entirely.

Shteynshlyuger hasn’t filed a new document request yet to uncover whether Zelis or perhaps another company influenced that decision. He has his suspicions.

Do You Have Insights Into Health Insurance Denials? Help Us Report on the System.

Insurers deny tens of millions of claims every year. ProPublica is investigating why claims are denied, what the consequences are for patients and how the appeal process really works.

Expand