Helping you consider differing viewpoints. Before it’s illegal.

Article 1:

‘Medicaid-for-All’ Rapidly Gains Interest in the States, Mattie Quinn, Governing, June 4, 2018

Clay’s summary: You silly gooses. Geese.

Key Passage from the Article

Six states — Iowa, Massachusetts, Minnesota, Missouri, New Jersey and Washington state — have active legislation to establish a Medicaid buy-in program. In four others, bills were proposed but stalled. New Mexico has set up a task force to study a Medicaid buy-in program, and Connecticut may do the same.

According to experts, each state likely has a different reason for considering this option.

“States are still exploring what it would even mean,” says Heather Howard, director of State Health and Value Strategies. “For one state, it could be about addressing a bare county. For another, it could be an affordability issue. For another, it could be about expanding competition. In the absence of federal legislation on health care, states are asking: ‘What tools do we have?'”

For left-leaning lawmakers, Medicaid buy-in is considered a step toward single-payer health insurance. But conservatives are wary of expanding the government’s role in health care and of funneling more money into Medicaid, which is already a huge slice of state budgets.

New Mexico state Sen. Jerry Ortiz y Pino — who co-sponsored a bill to study the issue — says Medicaid buy-in makes sense there because the majority of residents (54 percent) already have Medicaid or Medicare. It’s the only state where more than half the population uses government health care.

“Besides Medicaid, we have a high Medicare population, high VA [Veterans Affairs] population and high numbers in the Indian Health Service,” says Ortiz y Pino. “So when we talk about non-governmental insurance, it’s a small number. That small population means it’s hard to attract private insurers, particularly in the marketplace.”

New Mexico’s marketplace has four insurers covering the state, which is actually more than many part of the country. About half of Americans only had one or two insurers last open enrollment season. Still, like most other states, New Mexico’s marketplace is facing increased premiums and possible insurer dropouts this year.

…

Read it here

Article 2:

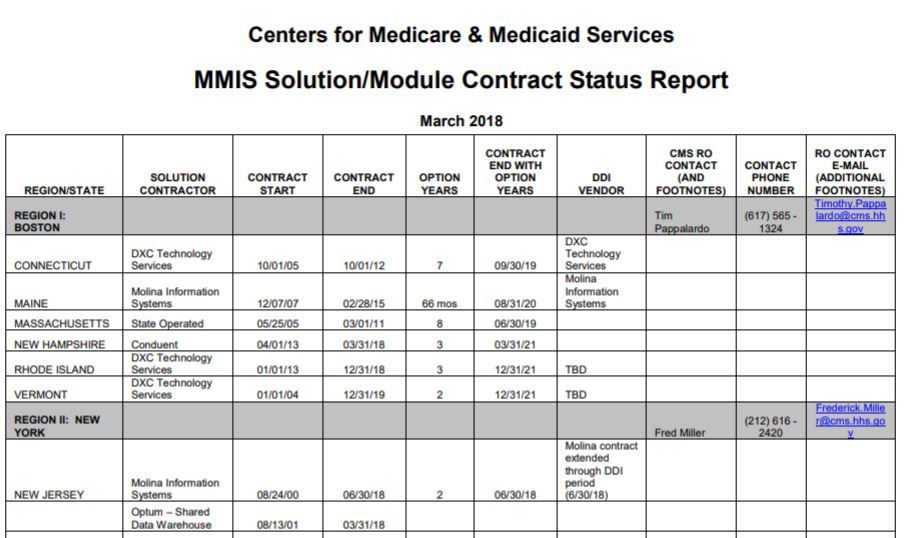

Fiscal Survey of the States, National Association of State Budget Officers, Spring 2018

Clay’s summary: Very important annual report that covers lots of insights from state budgets. Medicaid is always a big part of the analysis- starts on page 73 of this years report.

Key Passage from the Article

In fiscal 2017, states reported total spending for Medicaid expansion of $87.7B, $6.7B in state funds, and $81.1B in federal funds. In fiscal 2018, states are estimated to spend $91.2B in all funds, $10.3B in state funds, and $80.9B in federal funds.

Read it here

Article 3:

Lawmakers focus on flaws in Texas Medicaid program after Dallas Morning News investigation

Clay’s summary: Things are heating up for MCOs in the LoneStar state after a reporter decided to look into Medicaid managed care.

Key Passage from the Article

Part of the investigation focused on twins D’ashon and D’asia Morris, who were born with severe birth defects and were placed in foster care after they tested positive for drugs at birth. While D’ashon Morris was a foster child under Superior HealthPlan — a managed care program for foster children — he was denied 24-hour nursing care that would prevent suffocation, according to The Dallas Morning News’ report.

The report said providing that care would have cost Superior Health as much as $500 a day. One day, when D’ashon was in temporary foster care while his foster mother, Linda Badawo, was traveling outside the country, he started choking. After nurses and medics performed CPR for 40 minutes, D’ashon was taken to the hospital, where doctors concluded that he had gone too long without oxygen to his brain — he would be brain dead for the rest of his life.

“Superior is 100 percent responsible,” Badawo, who has since adopted D’ashon, told lawmakers Wednesday, her voice shaking. “I strongly believe that they don’t have any passion for what they do.”

It wasn’t until after the accident that Superior gave D’ashon 24-hour care, the Morning News reported.

“So my question to you was: ‘Was this a matter of life and death?'” state Rep. Mark Keough, R-The Woodlands, asked Superior’s representatives regarding 24-hour care for D’ashon.

David Harmon, Superior’s chief medical director, said his company did not believe so, based on the information it had. “If we did, we would not have authorized to continue” with 17 hours a day of care instead of 24, he said.

The story, Harmon said, “misrepresented the facts in all of these cases to make us look very bad.”

David McSwane, one of the Morning News reporters who wrote the investigative series, defended the reporting.

“The data, docs and patients in the stories tell the story,” McSwane tweeted during the hearing.

Mark Sanders, CEO of Superior HealthPlan, said Superior proposed using a “soft splint” to prevent D’ashon from pulling out a tube that helps him breathe. Badawo said she was horrified because state regulations bar her from using physical restraint on foster children in many situations.

Sanders, who showed an example of the soft splint to lawmakers, said the device was “in no way shape or form” like a restraint.

State Rep. Richard Peña Raymond, D-Laredo, told representatives from Superior that the company needed to become more aware that there were going to be members and patients who would need more attention than others.

“We’re going to stay on you,” Raymond warned. “We don’t want these things to happen. But if we don’t do it right, these things will bubble up.”

Representatives of private companies that manage Medicaid in Texas slammed the newspaper report for what they said were inaccuracies. LeAnn Behrens, west region president of AmeriGroup Medicaid, took issue with the report’s assertion that AmeriGroup is withholding care from patients in order to make a profit.

“As you all know, the state of Texas has set up a system that restricts the amount of profits that a managed care can make,” Behrens said. “Members get the best care, they get the right care at the right place — and you have confidence that I am being wise with taxpayer money.”

Read it here